Electric Bike Insurance USA Guide & Cost 2025 – Coverage & Providers

Electric Bike Insurance Cost USA 2025 is a key topic for riders using e-bikes for commuting, delivery, and recreation.

Whether you own a high-speed Class 3 e-bike or a folding commuter, U.S. regulations and rising theft rates make proper insurance more important than ever.

The popularity of electric bikes (e-bikes) in the USA is skyrocketing. Whether used for daily commuting, leisure rides, or delivery work, e-bikes offer convenience and eco-friendly travel. But with rising usage comes a key question: Do you really need electric bike insurance in the USA?

In this guide, we’ll explain state laws, insurance coverage options, costs, and whether e-bike insurance is worth it in 2025.

✅ Do You Legally Need E-Bike Insurance in the USA?

In most U.S. states, Class 1 and Class 2 e-bikes (up to 20 mph and 750W motors) do not require insurance or registration. However:

- Class 3 e-bikes (28 mph) may require insurance in some states (e.g., New York, New Jersey, California).

- If you use your e-bike for commercial delivery, insurance may be mandatory.

- Homeowners or renters insurance may cover theft, but not liability or accidents.

⚡ Insurance is not legally required for most casual riders, but it’s highly recommended for theft protection, accidents, and liability coverage.

✅ Why E-Bike Insurance Matters in 2025

Liability Protection: Covers injuries or property damage you cause.

Theft & Vandalism: Pays replacement cost for stolen or damaged bikes.

Collision & Damage: Repairs after a crash.

Medical Payments: Helps with your medical bills after an accident.

Tip: Standard homeowner or renter policies often exclude motor-assisted bicycles.

Average Electric Bike Insurance Cost in the USA (2025)

| Coverage Type | Typical 2025 Cost | Notes |

|---|---|---|

| Liability Only | $100 – $200 / year | Required in some states and by many HOAs. |

| Comprehensive + Theft | $150 – $400 / year | Covers collision, theft, vandalism. |

| High-Value E-Bike | 5–10% of bike value | For premium e-bikes worth $5,000+. |

Pricing Factors:

- State laws and local theft rates

- Bike class (1, 2, or 3) and replacement value

- Rider history and storage security

Top U.S. Electric Bike Insurance Providers (2025)

| Provider | Coverage Highlights | Starting Premium* |

|---|---|---|

| Velosurance | Theft, liability, medical, worldwide travel | From $8/month |

| Spoke Insurance | Racing & all-risk policies | From $100/year |

| Markel Insurance | Custom limits up to $30,000 | From $100/year |

| Simple Bike Insurance | Accessories, batteries, and add-ons | From $12/month |

| State Farm / Farmers | Add-on to homeowner policies | Varies by state |

*Approximate starting prices for 2025.

How to Choose the Right Policy

- Check State Laws: Some states (e.g., California, New York) now require liability for Class 3 e-bikes.

- Assess Replacement Value: High-end cargo or mountain e-bikes often exceed $6,000.

- Accessory Coverage: Batteries, GPS trackers, and child seats add value.

- Compare Deductibles & Limits: Balance premium vs. payout.

Money-Saving Tips

- Install a GPS tracker or smart lock.

- Store your bike indoors.

- Keep a clean riding record to earn safe-rider discounts.

Related Guides

- Best Electric Scooters for Adults in the USA

- How to Insure an E-Bike in USA

- Best E-Bike Loans & EMI Options

✅ Types of Electric Bike Insurance Coverage

When you buy e-bike insurance, here’s what’s usually included:

- Liability Coverage – Protects you if you cause injury or damage while riding.

- Theft Protection – Covers your e-bike if it’s stolen.

- Accident Coverage – Pays for repairs or replacement after a crash.

- Medical Payments – Covers your medical bills after an accident.

- Worldwide Coverage (Optional) – Useful if you travel with your e-bike.

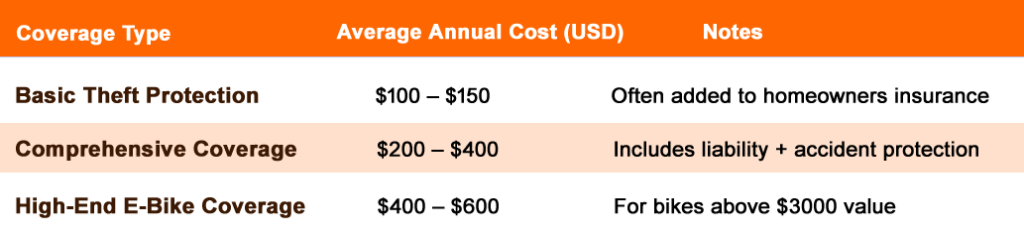

✅ Average Cost of Electric Bike Insurance in USA (2025)

Insurance costs vary depending on your e-bike’s value and coverage level.

⚡ Pro Tip: If your e-bike costs less than $1000, adding theft coverage to your home insurance might be enough. But for premium models, dedicated insurance is worth it.

✅ Why You Should Consider Insurance for Your E-Bike

Even if it’s not legally required, here’s why thousands of riders get insured:

✔ High Theft Rates – E-bikes are prime targets in cities like NYC, LA, and Chicago.

✔ Accident Protection – Medical bills in the USA can be huge after a crash.

✔ Delivery Riders – Apps like Uber Eats or DoorDash may require insurance.

✔ Peace of Mind – Sleep easier knowing your e-bike investment is safe.

✅ Best Safety Accessories to Protect Your E-Bike (Affiliate Section)

Insurance helps, but prevention is better. Pair insurance with must-have safety gear:

🔒 Heavy-Duty Bike Lock → Check on Amazon

🎧 GPS Tracker for E-Bikes → Check on Amazon

🪖 Certified E-Bike Helmet → Check on Amazon

👉 ( “safety gear” )

✅ Conclusion: Should You Get E-Bike Insurance?

While e-bike insurance is not legally required in most U.S. states, it’s a smart investment for riders who:

- Own high-value bikes

- Commute daily in busy cities

- Use e-bikes for delivery or business

At the end of the day, a few hundred dollars per year is worth the peace of mind and financial protection.

👉 If you’re investing in an e-bike, also check out:

- [ Best Electric Bikes Under $1000 ]

- [ Electric Bike Financing USA 2025 ]

- [ Best Accessories: Helmets, Locks, and Storage Racks ]

✅ Frequently Asked Questions (FAQ)

1. Is electric bike insurance required in the USA?

Not federally, but many states and landlords require liability coverage for Class 3 e-bikes.

2. Does homeowner’s insurance cover my e-bike?

Usually no, because e-bikes are considered motorized vehicles.

3. What if my e-bike is stolen?

Comprehensive policies typically pay full replacement cost minus your deductible.

4. Can I insure accessories and batteries?

Yes, most specialty insurers let you add accessories to your policy.

5. Are delivery riders charged higher premiums?

Yes, commercial use increases annual costs due to higher mileage and risk.

Arnold A. Jones: Your go-to source for electric scooters, hoverboards, and skateboards! Riding enthusiast and expert sharing tips, trends, and insights for riders of all levels. Stay in the know with Arnold’s expertise.

Leave a Reply